Cool Orologi: Timeless Trends

Explore the fascinating world of watches and timepieces.

On-Chain Transaction Analysis: Unmasking the Hidden Patterns of Crypto

Dive into on-chain transaction analysis and uncover the hidden patterns driving the crypto market. Discover secrets that could boost your gains!

Understanding On-Chain Transaction Analysis: Key Techniques and Tools

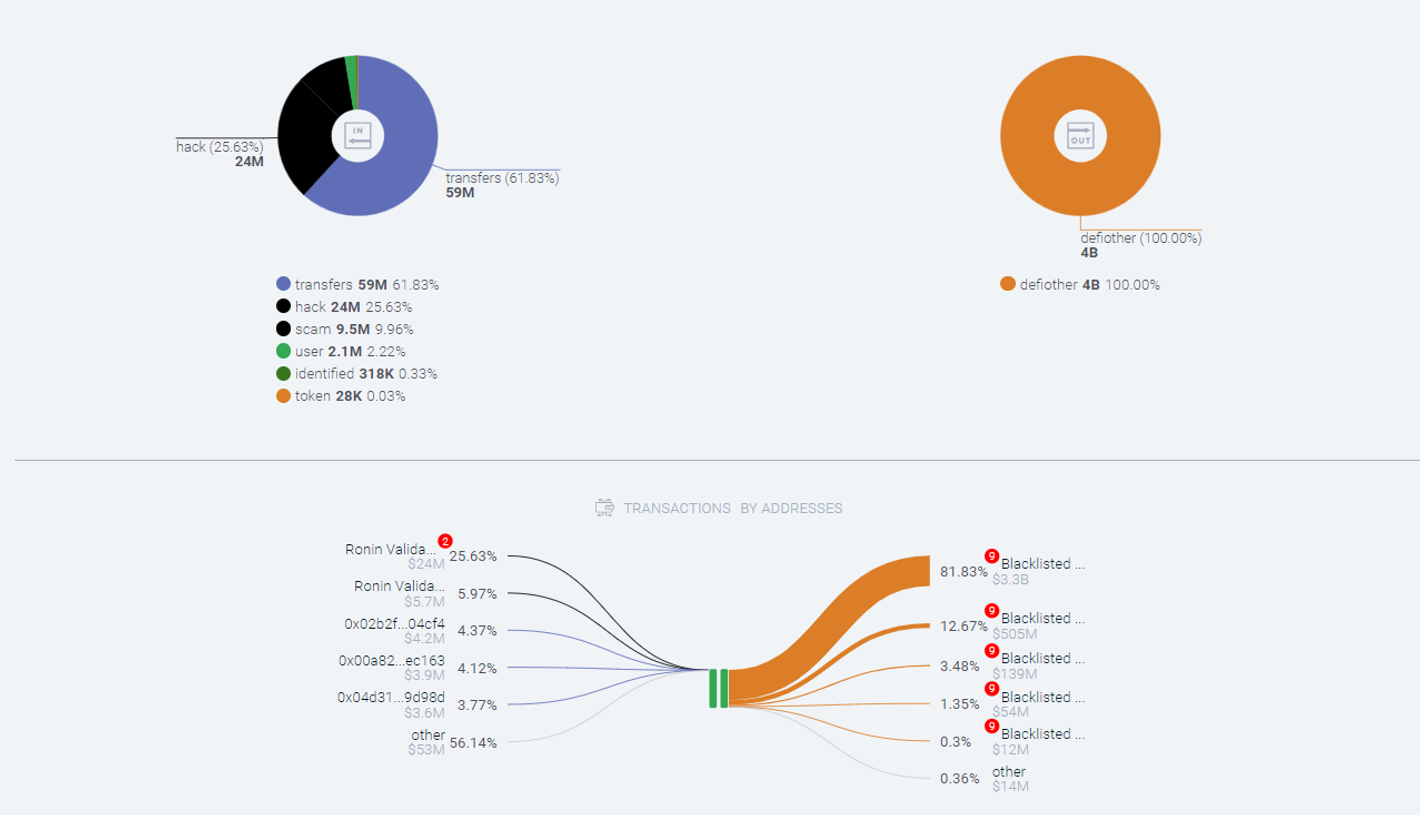

Understanding On-Chain Transaction Analysis is crucial for anyone looking to delve into the intricacies of blockchain technologies. At its core, on-chain analysis involves examining the data directly recorded on the blockchain. This process allows analysts to track transactions made using cryptocurrencies, providing insights into user behavior, network health, and potential fraudulent activities. Key techniques include address clustering, which groups addresses controlled by the same entity, and flow analysis, which visualizes the movement of funds throughout the blockchain. By employing these techniques, analysts can glean valuable information about market trends and emerging threats.

Several tools have emerged to facilitate on-chain transaction analysis. Popular options include Block Explorers like Etherscan and Blockchain.com, which offer user-friendly interfaces for tracking various transactions in real-time. Additionally, software platforms such as Chainalysis and Elliptic provide advanced functionalities for compliance and risk management. These tools not only help in identifying suspicious activities but also empower users by offering a clearer view of the cryptocurrency landscape. By leveraging these resources, businesses and regulators can enhance their understanding of blockchain dynamics and make informed decisions.

Counter-Strike is a popular tactical first-person shooter that emphasizes team-based gameplay and strategy. Players engage in various game modes, including bomb defusal and hostage rescue, requiring coordination and skill. For those looking to enhance their gaming experience, you can check out this bc.game promo code for exciting rewards.

How to Identify Hidden Patterns in Crypto Transactions: A Comprehensive Guide

Identifying hidden patterns in crypto transactions can provide valuable insights into market trends and potential investment opportunities. To start, it's crucial to employ robust analytical tools that can track and visualize transaction data. One effective method is to use blockchain explorers, which allow users to dive deep into transaction histories and monitor wallet activities. By analyzing features such as transaction times, volumes, and the regularity of transfers, you can unveil patterns that can suggest manipulation or emerging trends. Furthermore, integrating data from social media platforms and news sources can help contextualize transaction spikes, providing a broader understanding of the influencing factors behind the activity.

Once you've gathered your data, data analysis techniques can be utilized to identify recurring patterns. Employ methods such as clustering and anomaly detection to analyze the transactions systematically. For instance, using machine learning algorithms can help automate the identification of unusual transaction flows that could indicate wash trading or pump-and-dump schemes. Additionally, visualizing the data through graphs and charts can clarify these trends, making it easier to draw conclusions. By mastering these techniques, investors can become more adept at uncovering insights hidden beneath the surface of crypto transaction data, ultimately leading to more informed investment decisions.

What Insights Can On-Chain Data Provide for Cryptocurrency Investors?

On-chain data has emerged as a vital resource for cryptocurrency investors seeking to make informed decisions. By analyzing blockchain transactions, investors can gain insights into the overall health of a network, including metrics like transaction volume, active addresses, and wallet distribution. These metrics can help identify trends, such as whether more users are entering the market or if large holders, often referred to as whales, are accumulating or dispersing their assets. Understanding these patterns can aid in predicting potential price movements and market sentiment.

In addition to transaction data, on-chain metrics like hash rate, network fees, and miner activity can provide critical insights into the security and stability of a cryptocurrency. For instance, a rising hash rate often indicates a healthy network, as more miners are participating in securing the blockchain. Investors can also monitor token flows between exchanges and wallets to gauge liquidity and potential sell-off risks. By leveraging these analytical tools, investors can build a more comprehensive investment strategy that incorporates not just price trends but also fundamental on-chain data.