Cool Orologi: Timeless Trends

Explore the fascinating world of watches and timepieces.

Riding the Waves: How Crypto Market Volatility Affects Your Financial Future

Discover how crypto market volatility can shape your financial future. Ride the waves of change and secure your wealth today!

Understanding Crypto Market Volatility: Key Factors That Influence Your Investments

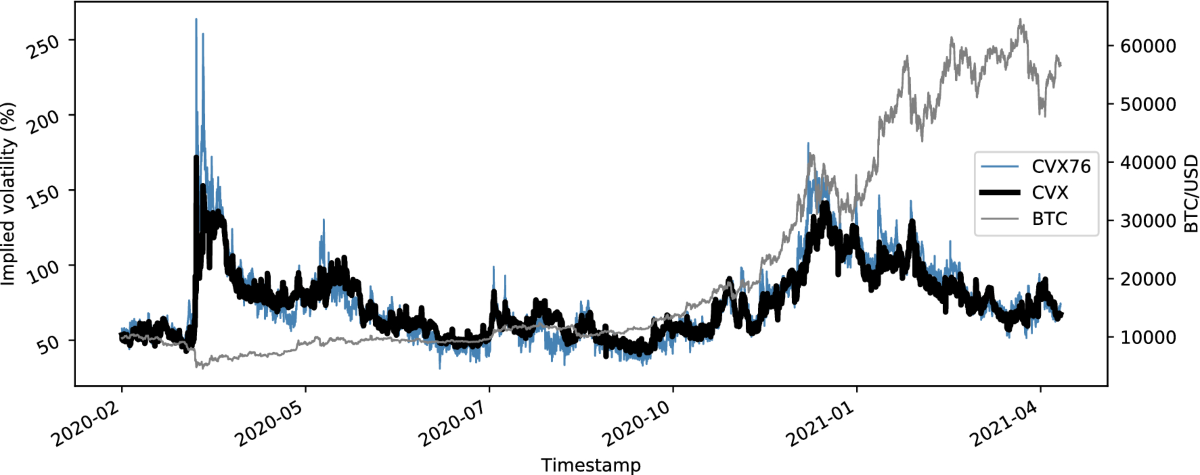

Understanding the dynamics of the crypto market is essential for any aspiring investor. Crypto market volatility is influenced by a multitude of factors, each contributing to the rapid price fluctuations that characterize digital assets. Key factors include regulatory news, where government policies can lead to sudden changes in investor sentiment. Additionally, market sentiment itself, driven by social media trends and community discussions, plays a pivotal role in shaping how traders react. Economic events, such as inflation rates or significant financial crises, can also impact the perceived value of cryptocurrencies, leading to increased buying or selling pressure.

Another critical component influencing crypto market volatility is market liquidity. When trading volumes are low, even minor transactions can lead to major price swings, creating an unstable environment for investments. Furthermore, the types of cryptocurrencies themselves can vary widely in terms of stability; established coins like Bitcoin may experience different volatility patterns compared to newer altcoins. Lastly, technological developments within the blockchain space can drive innovation, creating excitement or fear that affects market behavior. As an investor, staying informed about these factors and how they interplay can better position you to navigate the turbulent waters of the crypto market.

Counter-Strike is a popular first-person shooter game that has captivated millions of players worldwide. It includes various game modes, allowing players to indulge in team-based tactics and strategic gameplay. Players can also enhance their gaming experience by using resources like the cloudbet promo code to access exclusive offers.

How to Navigate Market Swings: Strategies for Managing Your Crypto Portfolio

Navigating market swings in the cryptocurrency space can be challenging, but employing effective strategies can help you manage your crypto portfolio more efficiently. First and foremost, it is crucial to maintain a long-term perspective. Instead of reacting impulsively to short-term price fluctuations, focus on the fundamentals of your chosen assets. This could involve regularly assessing project developments, market positioning, and overall adoption trends. Additionally, consider establishing a diversification strategy that spreads your investments across various cryptocurrencies, reducing the impact of volatility on your overall portfolio.

Another key strategy is to implement risk management techniques. Setting stop-loss orders can help you limit potential losses during market downturns, while also allowing you to secure profits when prices surge. Furthermore, keep a close watch on market sentiment and news, as these factors can significantly affect price trends. Utilizing tools like technical analysis can provide insights into price movements, enabling you to make more informed decisions. Remember, staying calm and collected during market volatility is essential; emotional trading often leads to unfavorable outcomes.

Is Crypto Volatility a Friend or Foe? Exploring the Long-Term Impact on Wealth

The world of cryptocurrency is notorious for its volatility, which can cause significant fluctuations in asset values within short periods. Many investors wonder if this characteristic is a friend or a foe in the long run. On one hand, the rapid ups and downs can present opportunities for savvy traders to capitalize on short-term gains. Conversely, the unpredictable nature of crypto markets can lead to substantial losses, eroding wealth and causing emotional distress for investors. Understanding this duality is crucial for anyone looking to navigate the complex landscape of digital assets.

As we explore the long-term impact of crypto volatility, it's important to consider both the potential rewards and risks. For some, investing in cryptocurrencies has become a viable strategy for wealth accumulation, despite the turbulence. Historically, cryptocurrencies like Bitcoin have rebounded after significant downturns, leading to impressive returns over time. However, others may find that their initial enthusiasm is dampened by market corrections and regulatory changes. Ultimately, whether crypto volatility is a friend or a foe may depend on individual risk tolerance, investment strategy, and the ability to remain informed and adaptable in a fast-evolving market.