Cool Orologi: Timeless Trends

Explore the fascinating world of watches and timepieces.

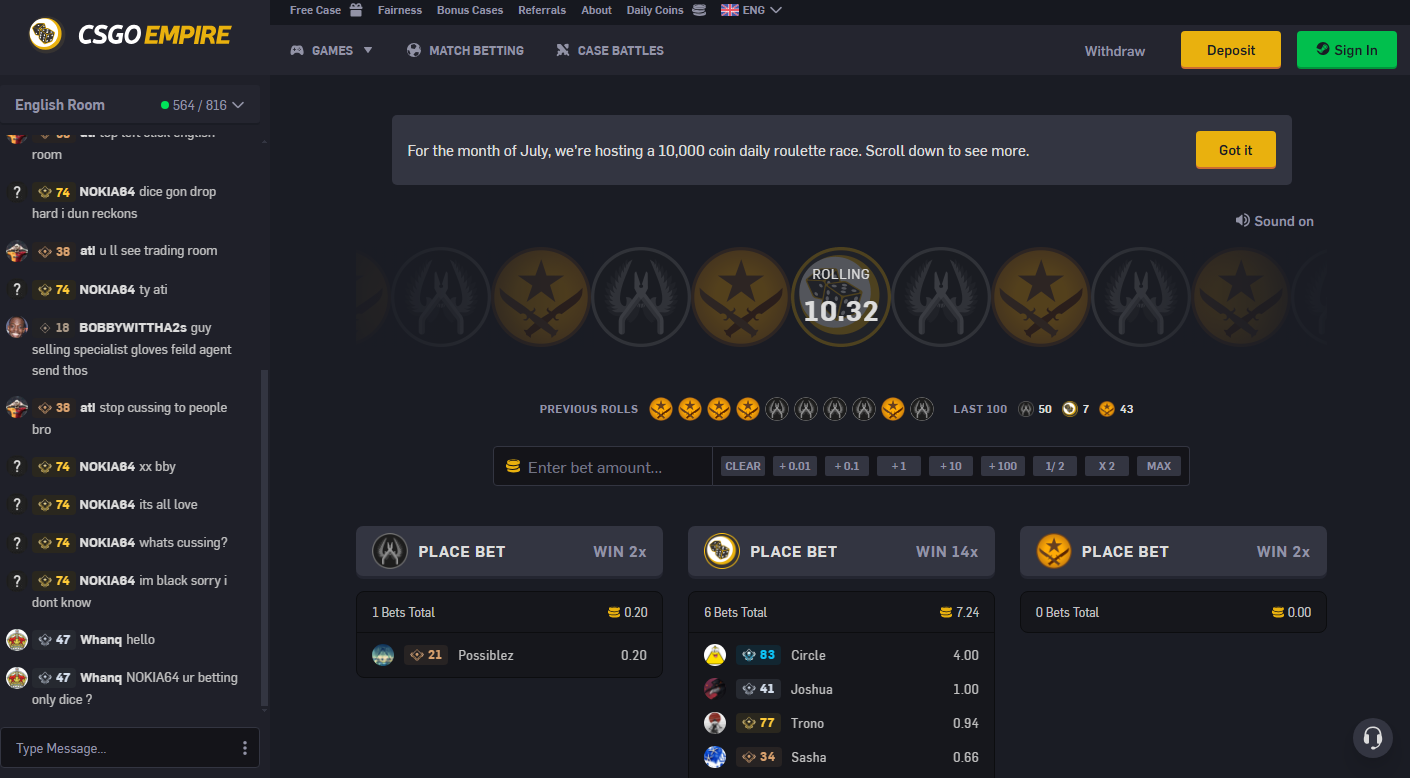

Trade Bots Unleashed: How CS2 Is Changing the Game

Discover how CS2 trade bots are revolutionizing the game! Unleash the secrets to boost your trading strategy and profits now!

Understanding the Impact of CS2 on Automated Trading Strategies

The advent of Counter-Strike 2 (CS2) has brought significant changes to the landscape of automated trading strategies. As traders and gaming enthusiasts delve into this updated version, it becomes crucial to analyze how the modifications in gameplay mechanics and economic systems can affect trading algorithms. With its new features and enhanced graphics, CS2 offers a different trading environment, which necessitates a reassessment of existing automated trading strategies. Understanding these changes can help traders adapt their approaches to better capture opportunities in the in-game economy.

Moreover, the impact of CS2 on automated trading strategies is not just limited to the gameplay itself but also extends to the community and market dynamics surrounding the game. As the player base evolves, so do the patterns of supply and demand for virtual items. This shift could influence how trading algorithms perform, highlighting the necessity for continual optimization. Automated trading strategies must be able to respond to social sentiment, market trends, and data analytics to maintain profitability in this rapidly changing environment.

Counter-Strike has been a cornerstone of competitive gaming since its inception, evolving with various versions over the years. The latest installment, known as CS2, introduces new maps and mechanics that enhance gameplay. Players can improve their experience by exploring unique items like the CS2 Stash Box, which offers exciting possibilities for customization and fun.

Top Benefits of Using Trade Bots in CS2 for Optimal Market Performance

In the rapidly evolving landscape of CS2, utilizing trade bots can significantly enhance market performance. These automated systems take advantage of advanced algorithms to execute trades at optimal times, reducing the need for constant monitoring. One major benefit is the ability to make swift decisions based on real-time market analysis, which can lead to increased profitability. By leveraging trade bots, traders can also implement strategies that they might not normally execute manually, such as arbitrage and market making, ensuring they never miss out on profitable opportunities.

Another noteworthy advantage of using trade bots in CS2 is the minimization of emotional trading. Decisions driven by emotions can lead to significant losses, while bots operate based on predefined strategies and parameters. This helps in maintaining a consistent trading approach and reduces the risk associated with market volatility. Furthermore, trade bots can analyze vast amounts of data more efficiently than a human trader, thus providing insights and trends that can enhance overall trading strategies and lead to superior market performance.

How CS2's Advanced Features Are Revolutionizing Algorithmic Trading

In the rapidly evolving world of finance, CS2 is making significant strides in revolutionizing algorithmic trading. By integrating advanced features such as real-time data analysis, machine learning algorithms, and predictive analytics, CS2 empowers traders to execute transactions with unprecedented speed and precision. This not only enhances trading strategies but also minimizes risks associated with market volatility. As traders leverage these features, they gain a substantial competitive edge, allowing them to capitalize on fleeting market opportunities.

One of the standout elements of CS2 is its ability to perform complex calculations and run simulations at lightning speed. Traders can harness this capability to backtest their strategies against historical data, refining their approaches to maximize profitability. Moreover, CS2's user-friendly interface ensures that even those with limited technical expertise can navigate its advanced features. As a result, CS2 is not just a tool for expert traders; it is transforming the landscape of algorithmic trading, making sophisticated strategies accessible to a broader audience.